It’s National Career Development Month: Time to Start Investing?

November is National Career Development Month, which means it’s a great time to look at your future career goals. Whether you’re a student or a professional already established in a particular field, it’s never too late to evaluate your next steps. Today, we’ll go over National Career Development Month, how to elevate your career, and tips for investing in real estate.

Contents of This Article:

- What Is National Career Development Month?

- How to Elevate Your Career This Month

- Should You Consider Real Estate Investing?

- Real Estate Investment Tips for Beginners

- Protect Your Investment Properties With BMG

What Is National Career Development Month?

National Career Development Month occurs each November, giving students and employees time to focus on their future career choices. This month-long initiative encourages individuals to reflect on their career goals, seek opportunities for skill development, and explore various career options.

During National Career Development Month, many schools and businesses host events that give everyone hands-on experiences. Whether it’s connecting students with professionals in various careers or providing learning opportunities to employees, there’s room for everyone to grow and develop new career plans or ideas.

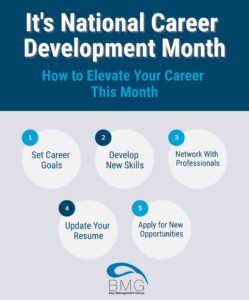

How to Elevate Your Career This Month

Whether you’re just starting in a certain field or have been a working professional for years, there’s always time to elevate your career and work skills. If you’re looking to elevate your career this month or year, here are some steps you can take to make progress.

- Set Career Goals- Think about what you’re looking to achieve in your career, whether it’s learning a new skill, networking with industry professionals, investing, or applying for a certain job.

- Develop New Skills- Identify skills relevant to your career goals and work on strengthening them. This may involve taking an online course, attending workshops, or looking for a mentor.

- Network With Professionals- Connect with coworkers, industry professionals, or a potential mentor who can help you achieve your goals. Branch out by attending networking events, joining professional groups, or engaging on social media platforms like LinkedIn.

- Update Your Resume- Make sure your resume and LinkedIn profile are up-to-date and showcase your skills and experiences. Don’t forget to highlight any recent achievements or certifications that show your skills.

- Apply for New Opportunities- If you’re looking for a new career or to elevate your current job status, search and apply to jobs or projects that align with your goals. Remember to tailor your applications to each specific opportunity.

Should You Consider Real Estate Investing?

If you’re exploring careers this month, perhaps you’ve stumbled upon real estate investing. No surprise if you have, since investing in real estate can be a lucrative and rewarding career choice for some people. However, it’s not for everyone. So, how do you know if real estate investing is right for you?

There are several ways to invest in real estate, all with different benefits and drawbacks. Most people like real estate because there are many methods to consider, giving opportunities to those looking for high returns or those who don’t have much to invest. For instance, you can purchase single-family homes to use as rental properties or form a partnership to help you fund an investment.

That said, real estate investing takes a lot of time and effort. Although you may hear that it’s a way to make passive income, it ultimately depends on your strategy. Most real estate investments, like rental properties, are active investments requiring continuous maintenance and attention.

Ultimately, the benefits of real estate investing make it enticing for most people. For instance, it can serve as a hedge against inflation, there are several tax benefits, and you can benefit from property appreciation. So, if you want to put the time and effort into real estate investing, it may be a great career path for you.

Real Estate Investment Tips for Beginners

If you’re thinking about branching out into real estate investing at some point in the future, it’s important to do some research first. Here are some real estate investment tips for beginners looking into the career path.

- Come Up With a Strategy

- Choose an Area Wisely

- Know the Costs Involved

- Find a Good Mentor

- Understand the Risks

Come Up With a Strategy

Think about your investment strategy early on. For instance, are you interested in investing in residential properties, commercial real estate, or a mix of both? Additionally, consider whether you’re leaning toward rental properties, fix-and-flip projects, or other investment approaches. Developing a strategy before putting money into a property can help you develop clear goals and navigate the process more smoothly.

Choose an Area Wisely

Location is arguably the most important aspect of any real estate investment. As such, it’s crucial to research and select areas with strong markets, potential for growth, and amenities that attract tenants or buyers. That said, the location you choose may depend on your investment strategy.

Know the Costs Involved

Investing in real estate typically requires a lot of capital. So, it’s essential to understand all the expenses associated with your chosen investment strategy. This includes the purchase price, closing costs, property taxes, insurance, maintenance, potential renovation costs, and property management.

Find a Good Mentor

If you’re new to real estate investing, consider finding a mentor to help you navigate essential processes. Having a good mentor can give you guidance and helpful insights, especially if you’re a beginner. That said, you’ll want to look for experienced investors or real estate professionals willing to share their knowledge and skills.

Understand the Risks

Know that real estate investing comes with risks. For instance, you have to consider market fluctuations, unexpected expenses, and changes in property values. As such, it’s important to be aware of these risks and have strategies in place to mitigate them.

Protect Your Investment Properties With BMG

Whether you’re a seasoned real estate investor or exploring the field for National Career Development Month, it’s important to look at all aspects. For instance, once you’ve got a steady investment property up and running, who will manage it? Some investors choose to become landlords and manage their properties themselves. However, some with larger portfolios don’t have the time to manage the day-to-day tasks for each property.

Luckily, Bay Property Management Group is here to help. Whether you own one property or 100, our team of expert property managers can help with every aspect of the rental process. From tenant screening to rent collection, maintenance, and inspections, we’ve got it covered. Contact BMG today to learn more about our property management services throughout Baltimore, Philadelphia, Northern Virginia, and Washington, DC.