Top 7 Ways to Save Money as a Renter in Fairfax

Compared to owning a home, renting is convenient and relatively accessible to most people. However, while some may assume renting is cheaper than homeownership, that’s not always the case. Rental rates are higher than ever, as are the costs of other goods and services. As such, you’ll want to learn how to save money while renting. In this article, we’ll go over common rental expenses and how to save money as a renter in Northern Virginia.

Contents of This Article:

- Average Cost of Living in Fairfax, Virginia

- How Much Are You Spending Each Month?

- 7 Ways to Save Money as a Renter in Fairfax

- Find a Reasonable Rental Home Today

Average Cost of Living in Fairfax, Virginia

Fairfax is a wonderful place to live, with several great opportunities for renters or homeowners. With outstanding schools, beautiful parks, and a thriving economy, Fairfax is known as one of Northern Virginia’s best places to live.

However, if you live in or around Fairfax, you know the cost of living is relatively high compared to the national average. So, if you’re considering living in this beautiful, bustling city, here are some monthly expenses to prepare for in a rental home or apartment.

- Average Rental Rate: $2,200

- Utility Costs: $150

- Transportation Costs: $430

- Food Costs: $280

- Healthcare: $230

Of course, these are simply estimates, and how much you spend each month depends on many factors. However, it’s important to know the average cost of living in Northern Virginia and how much you can plan to spend on necessities.

If you need help calculating costs, contact a property manager in Fairfax. Next, we’ll review some key tips for budgeting and how much you should spend on bills vs. entertainment.

How Much Are You Spending Each Month?

You’d be surprised at how many people have no idea how much they spend each month. Whether it’s necessary or personal expenses, some people pay no attention to how much they spend or save in a month. However, if you’re trying to save money and spend cautiously, it’s crucial to know your monthly income and expenses.

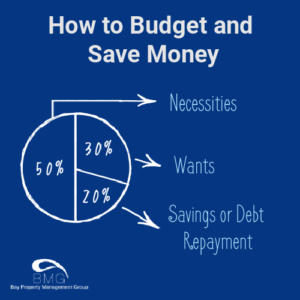

In 2020, the average income in Fairfax for a single person was around $50,000. That said, if you’re wondering how much to spend and save each month, there’s an easy way to calculate it. One of the easiest and most common budgeting rules to follow is the 50/30/20 rule.

What is the 50/30/20 Rule?

This rule states that you should divide your after-tax income into three spending categories: 50% for necessities, 30% for wants, and 20% for debt repayment and savings.

For instance, your most necessary costs include rent, utilities, transportation, insurance, loan payments, and groceries. Then, your non-essential expenses may include dining out, clothes shopping, or entertainment subscriptions. Finally, the last portion of your income should go toward your savings or outstanding debts.

7 Ways to Save Money as a Renter in Fairfax

If you don’t pay close attention to your income and expenses, it’s easy to overspend on non-necessary costs each month. For example, most people don’t even realize how many subscriptions they pay for! If you want to spend smarter, here’s how to save money as a renter in Fairfax.

Choose Your Location Wisely

Some areas are more expensive than others in Fairfax, Northern Virginia. As such, it’s essential to do research before moving to a new rental home. If you’re on a tight budget, look for more affordable rentals instead of luxury apartments or townhomes.

Some of the more affordable neighborhoods in Fairfax County and their average monthly rental rates include:

- Sudley- $1,682

- Lake Ridge- $1,819

- Lincolnia- $1,820

- Lorton- $1,912

- Mantua- $1,959

Cut Out Monthly Subscriptions

It’s easy to get caught up in monthly subscriptions. Whether it’s Netflix, a gym membership, or meal-planning kits, these subscriptions add up quickly. You’d be surprised at how many people pay for subscriptions they don’t use or don’t even know they’re subscribed to.

One of the easiest ways to save money as a renter is by reviewing your monthly subscriptions and canceling the ones you don’t regularly use. Even saving just $10 to $30 a month can quickly add up to saving hundreds over the course of a year.

Reduce Unnecessary Spending

If you struggle to make your rent and utility payments, it’s time to cut back on unnecessary spending. While balancing your wants and needs can be difficult, you’ll want to prioritize your living expenses wherever you are.

Sometimes, you may be unable to afford the rental home or apartment you want. For instance, if the amenities are attractive but ultimately too expensive to sustain, you’ll want to look elsewhere. Additionally, if you’re spending too much on entertainment and it affects your ability to pay necessary bills, it’s time to cut back and focus on necessities.

Consider a Roommate

One of the most straightforward solutions to save money as a renter is to get a roommate or a couple of housemates. There are several pros, but one of the biggest benefits is splitting the rent and utility bills. However, make sure you choose your roommate(s) wisely so you’re not stuck with an unfavorable living situation.

Negotiate Your Rental Rate

Sometimes when you decide to renew your lease at a rental home, your landlord will raise the rate after a year or so. After all, the market changes, and the cost of living increases, which is generally why increases happen. However, if you’re a good tenant, you may be able to negotiate your rate when it’s time to renew your lease.

Save on Energy Consumption

Utility bills can creep up on you, and so can their prices! If you find that your utility bill is higher than usual, check your habits and adjust them as necessary. For instance, if your water bill is higher than normal, try to reduce your shower time or turn the water off when you brush your teeth.

If you’re prone to leaving the lights on, make it a habit to turn them off whenever you leave a room. Unplugging appliances or electronics when you’re not using them can also help you save on electricity costs.

Make Meals at Home

Dining out can get expensive quickly–especially if you do it multiple times a week. While it’s more convenient to get takeout and more fun to go to dinner with friends, it’s significantly more pricey.

As such, just a few habit changes can help you save a ton of money as a renter. For example, grocery shopping and cooking meals at home can make all the difference in your monthly expenses. So, consider staying home, improving your cooking skills, and saving more of your monthly budget.

Find a Reasonable Rental Home Today

Living in a rental is an excellent alternative if you’re not ready to purchase a home yet. However, although it may be easier, it’s not always cheaper. After all, you must consider your monthly rent payment, utilities, and other monthly costs. All in all, if you want to save money as a renter, follow the tips in this article.

Check out Bay Property Management Group’s current listings if you want to move to a more affordable rental. We have several rentals available, whether you’re looking at something affordable or luxurious. If you find something you like, contact BMG for a showing.

On the other hand, if you need help managing your rental properties, our professional property managers can help with that, too! We offer full-service property management, including tenant screening, maintenance, rent collection, and more. Contact BMG to learn more about our comprehensive rental management services today.